3 Ways Never to Run Out of Operational Costs

Operational costs are the daily expenses for businesses and individuals. Managing these costs ensures financial stability and prevents running out of money.

When you think of operational costs, the first thing that comes to mind is probably a business owner or your supervisor talking about operational costs. But before you think too far, what is operational cost and how does it apply to you or not?

Operating cost simply means the money that is spent on running a business or on running your day-to-day activities. For businesses, this could be administrative costs, marketing costs, and the actual cost of producing the product if it is a product-based business. if it is not a product-based business, the money one spends directly on getting the services out there is also an operational cost.

38% of startups fail because they run out of operational costs and fail to raise more money. Therefore it is easy to see how a lack of operational cost can affect a start-up in the long run. Most times, start-ups do not have sufficient operational costs because they do not have clear data to show their spending and what to prioritize in the spending.

Running out of Operational cost is not just a start-up problem, but can also be an individual problem. if you earn a salary, you definitely have money set aside for operational costs. Your operational costs are transportation fare to your place of work, lunch at your place of work, and sometimes money for drinks at the close of work when you hang out with friends. if you are a financially conscious person, you would have done the math and known exactly what that amount would be for the 20 days that you need to show up for work in a month.

However, a quick interview with some friends on Facebook, showed that more than 50% of a population sample of 150 people say they run out of funds to go to work and cater to their day-to-day needs even before the next payday, and then have to rely on loans and loan sharks to get by before the next payday. if you have a business or are a salary earner and cannot manage to control your operational cost to last as long as you need it, here are things you can do:

- Create a budget and stick to it

It can be difficult to know the cost set aside for marketing, miscellaneous and other expenses if you do not set aside money for it and stick to it. As the year is split into quarters, it is best to plan how much to spend for each quarter and then plan your expenses around that sum that you have set aside. if you are a salary earner, calculate how much you need to get buy and do not use the money for anything else. This way, you will not run out of runway and have enough to last, until you can raise another fund.

- Use Digital Tools

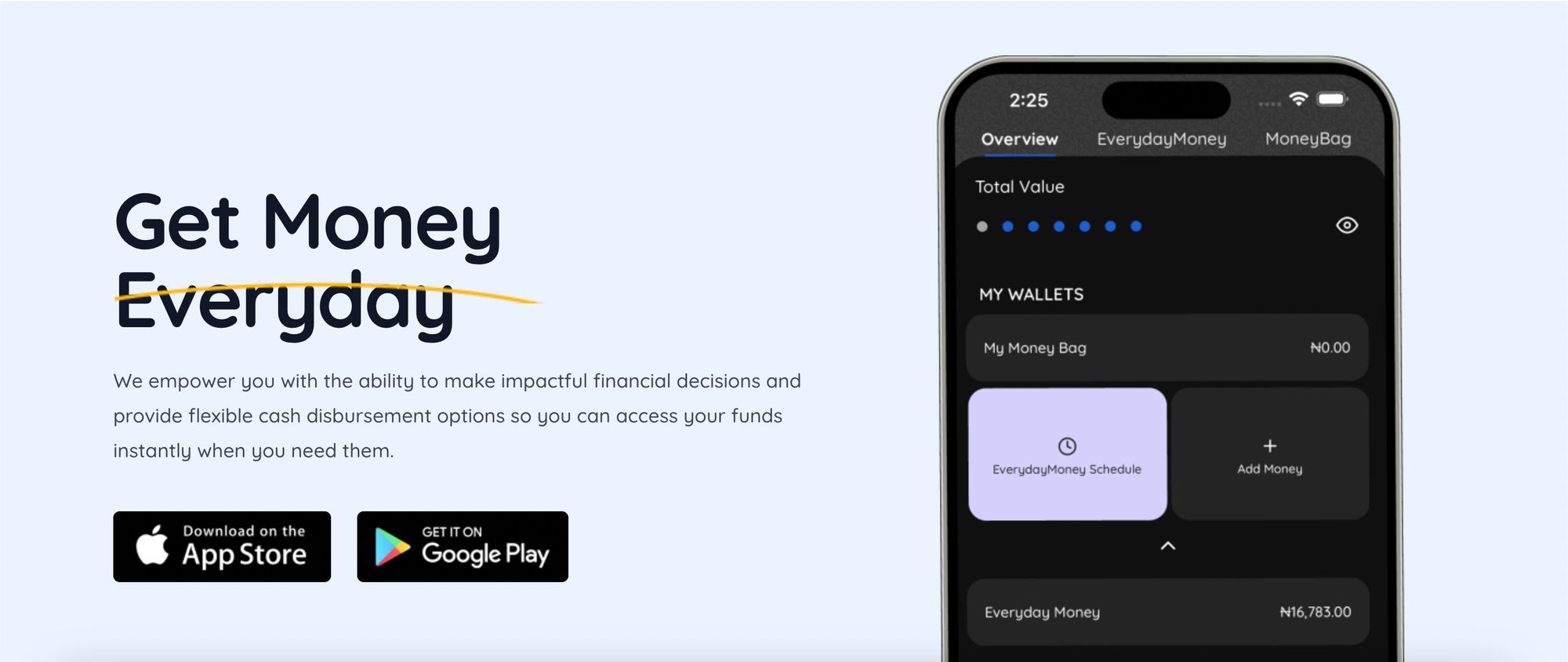

It may be difficult to track your expenses and even more difficult to stick to the plan intended for it when you have easy access to money and no form of restrictions whatsoever. Digital tools like Everydaymoney make it easy for you to do this, as it automates the sum that you have set to be disbursed for the expenses that you need. for example, if you say that you want $30 set aside for marketing, you can create a marketing budget wallet and the Everydaymoney App will disburse it weekly, bi-weekly or monthly, just like you set it.

- Find Cheaper Alternatives

When finding ways to reduce cost, find for cheaper alternatives that can reduce your overall cost and leave you with more money for a longer runway. in your organization, find roles that can be merged without overwhelming your workforce and merge them. There are also substitute raw materials that can do the work, and they are cheaper. Use them. Instead of using your car alone, car pool and have friends and colleagues hitch a ride with you, and contribute to the money for gas. All work and no play makes jack a dull boy, and relaxing and socialising should be part of your operational cost, but you should look for spots within your budget.

Conclusion

Finally, operational costs are an important part of running your business and gaining balance as a person. Therefore it is pertinent to plan and set aside funds for them.