The Rise of Digital-Only Banking in Nigeria Amidst Cash Scarcity

For the last couple of weeks, Nigerians have been experiencing hardship in terms of cash scarcity. The beginning of this was the government's announcement in October 2022, of the Naira redesign of ₦200, ₦500, and ₦1000 notes. When the new design was approved, citizens were asked to remit old notes before the end of January 2023. While the notes with the new design were released into circulation.

The Faults of the CBN and The Traditional Banks

According to the central bank governor, Godwin Emefiele, more than 80% of the ₦3.2 trillion in circulation in Nigeria was in private hands as of October 2022. This was a major inspiration behind the naira redesign. The CBN governor also said they aimed to reduce fraud, discourage cash ransom payments to kidnappers and bandits, and promote cashless transactions. The cash swap (old notes to new notes) enabled 75% of the ₦3.2million to be deposited with financial institutions before the presidential elections.

Unfortunately, the CBN failed to print adequate new notes to circulate, resulting in a scarcity of both New notes and old notes. It was reported that only a quarter of the old notes that were remitted to the banks, were returned into circulation as new notes.

The cash swap process was not well thought out. The citizens, as well as commercial banks, were left to bear the burden of a premature financial step.

The deadline for remitting old notes arrived, and videos online showed that a lot of old notes had still not been remitted. The deadline notice was short, banks became crowded with customers trying to meet up. Yet, there were not enough new notes in commercial banks to refund customers.

To this effect, a small portion of old notes remained in circulation alongside new notes. A new deadline, February 10, to remit all old notes was announced. Yet traders, motorists, market sellers, and other merchants began rejecting old notes before then. And new notes were still hard to come by. This rejection of old notes was mostly due to fear of being stuck with old notes when the new deadline would lapse.

At this point, most Nigerians who had little or no supply of new notes began to turn to cashless transactions. The rate of online transactions through commercial banks increased. It has been reported that there was a surge in online transactions since the beginning of January 2023. The Nigerian Interbank Settlement System stated that, in January, online transactions increased by 55 percent. To the further detriment of Nigerians, the digital payments run by commercial banks are often unreliable.

Due to this surge, the rate of failed transactions has continued to increase. Commercial banks frequently experience downtime in the network, transactions are processed slowly and not all banking features work simultaneously. When some banks have the network for card transactions, USSD (Unstructured Supplementary Service Data) transactions remain unavailable. While others may network for the latter, bank apps will be unavailable. High traffic of online transactions caused by cash scarcity and the cashless policy of the federal government is tasking traditional financial service providers.

Effect on Nigerians

Nigeria soon fell into a state of huge cash scarcity which has continued even after the presidential elections in February, till today.

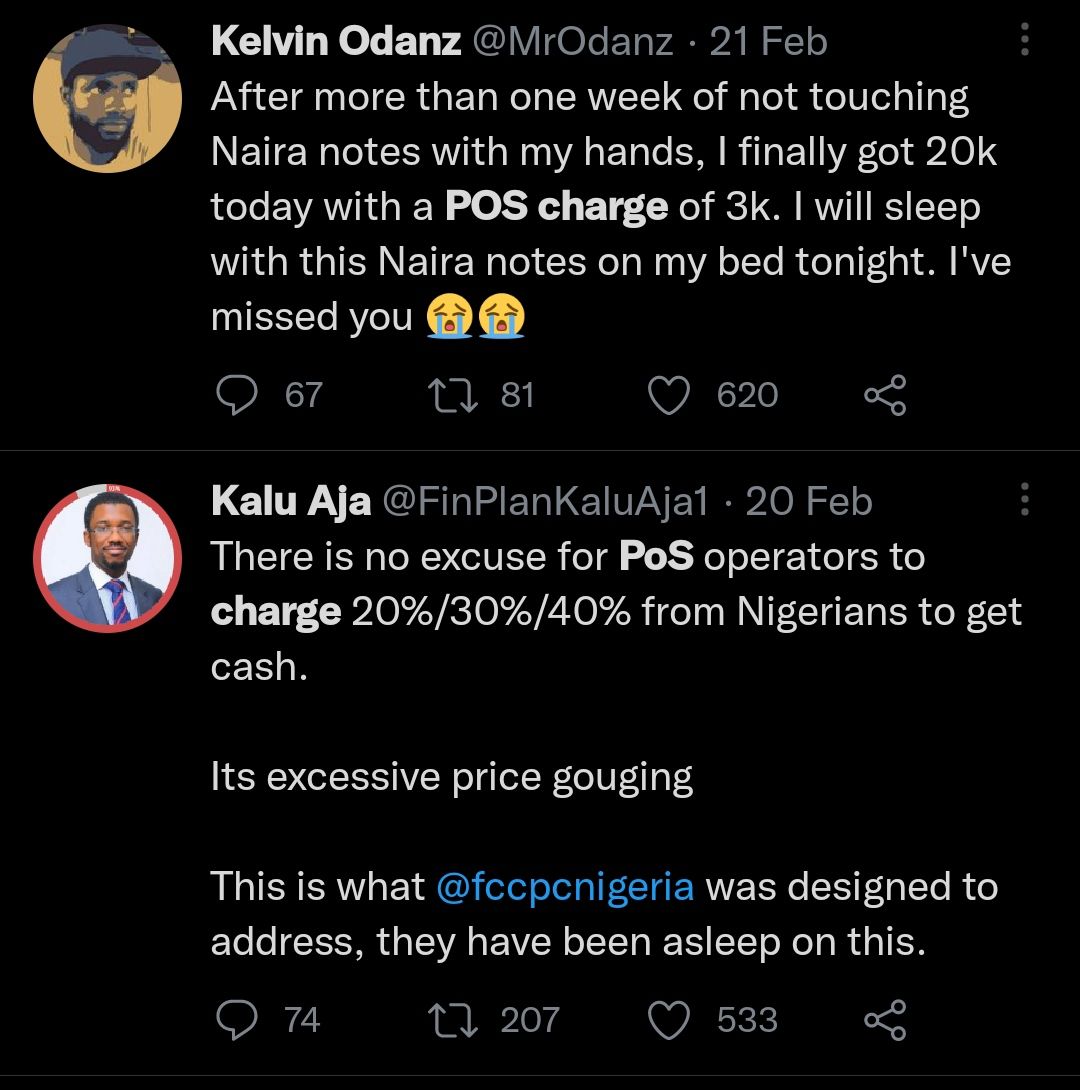

At the start of this cash scarcity in January, the majority had to constantly buy cash at ridiculously high charges from POS attendants. Some claimed that the commercial banks charged as high as 10 percent commission on every over-the-counter withdrawal for new notes.

This translated to Nigerians withdrawing from POS attendants at even higher rates. Typically a ₦5000 POS withdrawal will attract a ₦1000 charge. All working ATMs soon stopped dispensing cash, and long queues became the norm in bank premises for over-the-counter withdrawals. In the short time that followed, the central bank placed a limit on the amount that could be withdrawn by account holders.

Even after a circular from CBN has permitted the temporary use of both old and new notes till December 2023, getting a hold of cash is almost impossible. This forced citizens to turn to digital payments, even for petty needs like bike fares, and food purchases in the market. Many people working in the informal economy such as transportation use cash for transactions rather than banking apps. However, they have also resorted to opening digital accounts to continue transactions. These days, you can hear bike men at stops, beckoning passengers with "I dey collect transfer". A few weeks ago, market sellers and other merchants were clamoring for cash only. Now they have account numbers pasted in their shop for payment by transfer. Where a transfer option is unavailable, they liaise with POS attendants to debit the buyer's card with the total amount (charges inclusive).

Nigerians Turn to Digital banks and Fintech Apps

The cashless economy that Nigeria has been trying to enforce is coincidentally gaining momentum. But the banking infrastructure is still not ready for this complete cashless system. The endless transaction charges, long wait time for resolving failed transactions, and recurring network downtime among other disadvantages are overbearing. The banked Nigerians have started turning to fintech apps that provide better incentives.

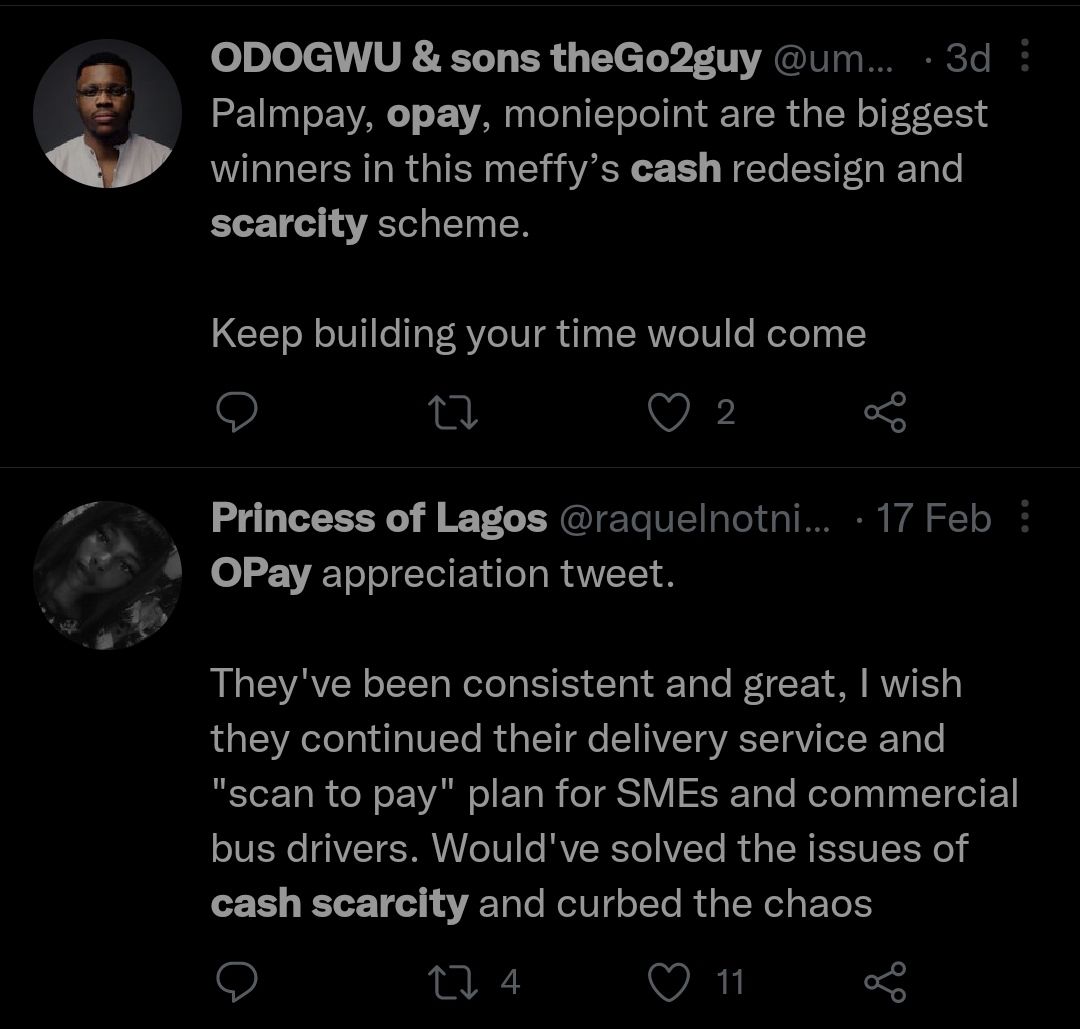

Nigerians without bank accounts have been forced to open one with the local digital-only banks. Since we all need to buy or sell, and can't completely rely on traditional banks. One such fintech initiative is Opay. Opay began trending on social media due to the popularity in demand for their service. The four-year-old fin-tech company has been operating in the capacity of our traditional banks and providing seamless services in my experience. The cash scarcity has presented the opportunity for their customer base to grow.

A brand like Opay developed smart customer incentives like an instant digital account opened with your phone number, and withdrawal cards at the rate of N500. And they were offering customers N5000 cash for withdrawal before scarcity heightened. They have zero charges and instant transfers. There are no SMS alert charges as well since all services remain in-app.

In a statement to Techcabal, Femi Hansen, OPay’s PR & Communications manager, said “We have significantly invested in our payment infrastructure to ensure our system can withstand a cashless environment. We believe that peer-to-peer payments are the future of payments in Nigeria, so we were not caught unaware, we were prepared for new users and built the technology infrastructure that supports it,” They have over 25 million app downloads and that number grew in the last two months.

Femi included that Opay has experienced a high influx of first-time users and has gotten a fair share of challenges. However, they have been well prepared for the cashless economy. He said, “We have experienced some challenges in recent times because our infrastructure is resilient and we have been able to adjust quickly to transaction demand. However, most transactions have to go through other players whose infrastructure might not be as resilient as ours. We have seen some of this recently and that’s an ecosystem challenge that we have to address.”

Perhaps this is good timing for the CBN regulation for Open banking in Nigeria. The monopoly of financial assets is no longer with the traditional banks. Access to financial data is so much easier with the CBN guidelines published on the 7th of March. Fintech companies can capitalize on using APIs to serve consumers better. The mere permission of a customer will avail their data from their commercial bank to any digital bank or service provider. The options of financial services will be more to choose from and customers will continue to move on from traditional to digital banking.

The banking IT infrastructure structure needs to take cues from these digital-only banks. The need for improving their capacity is an understatement. Several other fintech apps providing similarly reliable banking services include Kuda, Palmpay, Pocket app, Carbon, etc. Like traditional banks, they provide bank accounts, security for funds, and features for transacting with merchants. These brands have all reported an increase in customer base since the cash scarcity started in Nigeria.

Nigerians are now presented with reliable features of fintech apps for managing personal and business transactions and the already-tested epileptic services of commercial banking infrastructure.