Top 10 Budgeting Goals For Young Nigerians in 2023

Identifying your financial goals is a good way to gradually attain financial freedom. Financial freedom is not the same as spending however we like. It is spending purposefully and being able to maximize the use of funds within reach.

What are financial goals?

Financial goals are outcomes we aim for creating a budget. They are targets that money can be used to achieve. Listing financial goals is a key step in good money management. Financial goals can be tied to items you save for, spend on, earn from, or invest in.

Budgets usually involve splitting funds between Needs (including savings) and Wants, hence financial goals are driven by needs and wants. A good financial goal should be specific, realistic, measurable, attainable, and time-bound. Financial goals are either, Short-term, mid-term, or long-term.

As Nigerians, there are certain items most of us spend regularly on. The following are the most common financial goals for Nigerians:

1. Rent

A large population of Nigerians are not homeowners. Renting apartments, property, and office spaces among other things is common. You can’t afford to neglect to save toward this financial goal. No one wants a situation where property owners or agents evict them for defaulting payment. It is necessary to save towards rent for the next period as early as the month after you have paid for one period.

2. Data and Airtime

In this computer and digital era, most individuals and businesses own smart devices that need an internet connection for optimal productivity. Buying data is a weekly, monthly, and even daily commitment for some. Internet data is useful for sending emails, making web research, streaming audio or visual content, and using other productivity tools online.

The most advisable data plans to subscribe to, however, are monthly or yearly plans if you can afford them. The Gigabyte offers are wholesome and last for a longer period. Having a monthly plan will help build discipline on how to use data sparingly.

If you don’t have data on your phone, you may need to buy airtime for local and international calls. But for smartphones, having internet data avails the option of online calls via downloaded apps like WhatsApp, Skype, Instagram, etc.

3. Logistics/Transportation

Whether you own a private vehicle or use commercial vehicles it is important to make provisions for transportation. Everyone in Nigeria has to move from one place to another at some point. For private vehicle owners, transportation costs may go into buying fuel, oil, or other car maintenance costs. Others need to factor in money for bus or cab fares.

4. Sustenance – Food, water, drinks

These are needed for daily upkeep. It is not wise to skip eating just to save money or time for other things. As long as you can afford to, allocate funds in your budget for at least two meals a day and enough drinkable water. Drinks could also include fruit juice or tea, not necessarily carbonated sodas. The body functions better with healthy food and lots of hydration.

5. Electricity/Fuel

The reality of electric power in Nigeria is that there is inadequate supply from authorized sources. Many citizens survive by paying high electricity bills, buying fuel to power generators, or doing both. This financial goal can not be overlooked. Individuals and businesses need a power supply to charge devices, enjoy leisure time, and provide services that yield income. Over time, we can study our need for light and estimate how much money to allocate towards it in our budget.

6. Black Tax/Grandma Don Swallow Razor Blade

"Saving money in nigeria is very hard...U save little BOOM

— Adébáre (@iam_cheriff) January 11, 2019

They call you dat "grandma swallow razor blade send something"🙄😕😕😕

Black Tax is any financial responsibility of relatives, friends, or family, borne by someone perceived as “more successful” in their circle. It is a norm in Nigeria to demand money from your friends and family. Including it as a financial goal in your budget only makes sense. When the money is exhausted for a period, you know you can’t give out money anymore until you top up the balance for that goal.

Family Billings/problems can be exhausting, because how tf did grandma swallow razor blade.😩😭😩

— ỌMỌ́TÁRÁ ÀKÀNNÍ-LAWRENCE (@_theladymo) February 21, 2022

7. Medicine/ Health care

This is an unpleasant circumstance, but it should be provided for. No one hopes to get ill, but setting aside funds for your health is not a bad idea. If you don’t fall sick for an expected period, you could use healthcare funds for routine checkups or health supplements.

8. Bank Charges – SMS, Card maintenance, Transfer fees

The traditional banking system has continually burdened consumers with one charge or another. There are fees for balance inquiries, SMS alerts, Fund transfers, card issuance, and maintenance.

9. Entertainment – Outings/ Receiving Guests

There’s no rule against budgeting for fun activities. We all crave some leisure time now and then. It could be clubbing, going to the movies, eating out, or attending concerts. Sometimes we need money to entertain visitors at home. In Nigeria, it is almost impossible to not have friends or family visit often. An entertainment fund is therefore valid in a Nigerian’s budget. Even if you don’t use your exhaust entertainment budget in a month, the extra cash can be rolled over to the next month.

For movie and TV lovers, a Netflix and DSTV subscription is an important part of their day. It is good to factor this in when you want to budget for entertainment. Watching shows or movies is a good pass time when hosting guests at home.

We can all relate with the fact that lots of 'owanbe' or ceremonial occasions happen on weekly basis in Nigeria. Asoebi / Uniforms are common for such occasions like weddings or birthdays. These uniforms are a form of support to the hosts or celebrants asides your presence. If you're the type that likes to party, think ahead of these dates and make provision for buying them.

10. Gifts/Urgent2k

Holidays, birthdays, and anniversaries among other memorable dates are the usual times to appreciate loved ones with gifts. Gifts can strain our finances but planning for them can reduce that strain. Think of how much you would typically spend on gifts and the number of people you owe gifts to in a year. That would generate an estimate of how much you need to save towards gifts.

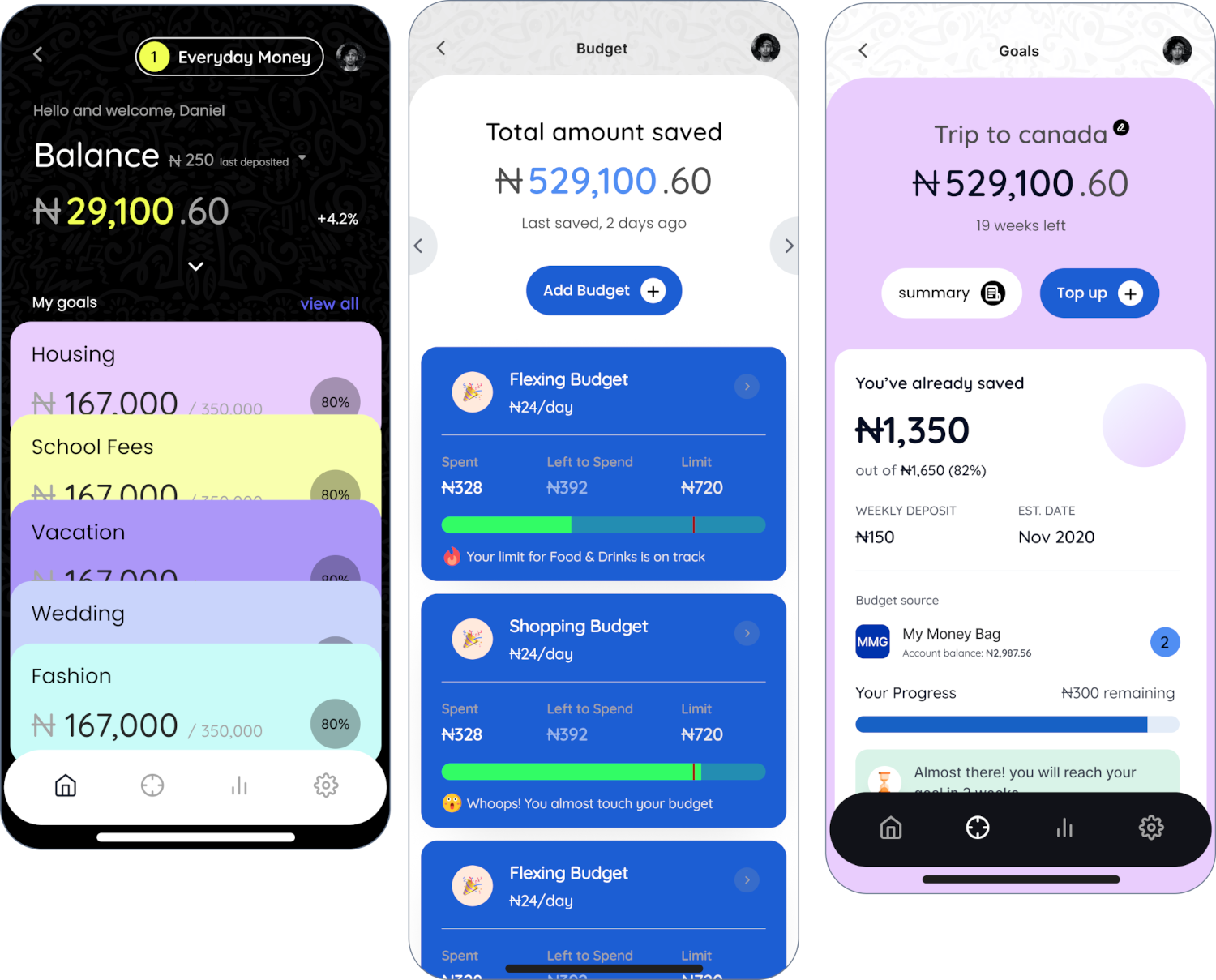

Streamlining Your Finances with EverydayMoney

When preparing a budget, it is easy to overlook or forget certain goals. And where a budget is absent, we likely misuse funds on some goals, while neglecting others. Personal finance is not easy to manage. The EverydayMoney App provides a reliable solution via its personal finance automation features. It helps users develop good savings culture by setting up financial goals, savings, and spending plans.

Financial goals and budgets created with the app are funded from what the app calls "My Moneybag" (user’s income balance) which is where goals and budgets are funded from according to the customisable rules set by the user. The app also shows the expected time and date for the achievement of each goal accordingly.

In the case of Budget, the apps simply ensure limited access to funds for petty expenses. Like for goals, money flow directly, either daily, weekly, or monthly, from the user's Moneybag into each budget goals created by the user. Some notifications encourage users to save and caution them on spending.

Automated personal finance is a smart way to make the right savings, investment, spending, and protection choices and EverydayMoney app makes it easy to stick to your budgets and reach your financial goals.