How To Avoid Loan Sharks

If you have not received an embarrassing message before from borrowing money from online loan apps that are peddling as Fintech companies, you have someone on your contact who has borrowed from them and you became aware when you experienced second-hand embarrassment.

These apps promise you instant loans with no collateral. However, as with everything that looks too good to be true, they collect your data by asking you to allow access to your messages, phone book, and location. Then they make you check the agree to the terms and conditions box so that they can say you agreed.

in your desperation, you do not think of the implications of granting access to your privacy. you need money, and here is a chance not to stand in a bank queue to get it and you don't have to do any form of paperwork.

You do not know it yet, but you will default. Because the reason why you are collecting the loan in the first place is that you did not plan with your income or you have no tangible source of income. and when you default by 1 day, the messages, and threats start coming in.

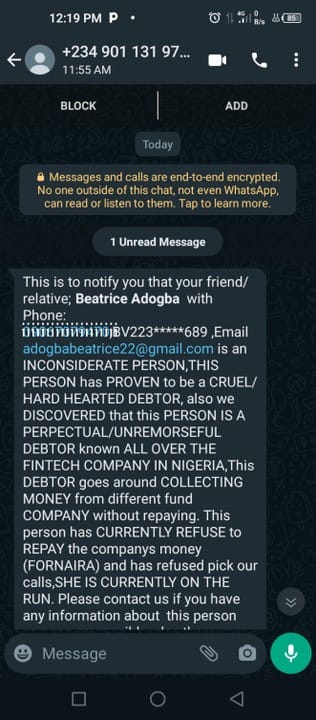

They have your photo because they asked you to take one the moment you decided to use the app and now they have everything about you. On the second day, while you are trying to borrow from another place to pay back this loan, your phone does not stop buzzing. They call you, send you messages, and then follow it up with insults.

On the third day, they know now that you can not pay, because apparently 40% interest on a two-week short-term loan is ridiculous and there is no way you can find that money to pay because you were broke in the first place, and that is why you borrowed it. Then they will begin to send your image with nasty messages to the numbers of your family and friends whom they know you respect and they in turn respect you. The aim is to shame you to pay. Your shame becomes their weapon.

How To Solve Loan Shark Problems

The best way to solve loan shark problems is not to get involved with them in the first place. and the best way not to get involved is to do the following things:

- Discipline yourself and live below your income: whatever you do, make sure you are living within the money you earn. Ensure that your expenses do not exceed what you currently earn. For example, instead of using a hailing cab as your means of transportation, use the government-provided public transport system. Let your house rent not exceed three months of your salary. Cut down on weddings, visiting the spa, and spending on frivolous things, and lean more on DIYs.

- Learn to say "I cannot afford this": this may sound like an easy phrase, but it is one of the most difficult phrases for people to say. they often think that it connotes weakness, but nothing speaks strength like knowing one's limitations and acknowledging them. Until you can increase your income let your mantra be "I cannot afford this":

- Avoid Gambling: gambling is a habit that thrives on your hope until you become addicted to that hope. A small survey showed that many people who owe different loan apps do so to gamble, with the hope that the next bet will be their big win. And before they know it, they are in a rabbit hole that they cannot come out of.

- Set aside emergency Funds: Other people have given the excuse that the reason for their debt is one emergency or the other. This is a plausible reason, considering that they are unforeseen circumstances. However, emergencies can be tackled if you have emergency funds. Always set aside 10% of your income for emergencies.

- Use a budgeting App: if you struggle with managing your finances and don't even know where to begin, the Everydaymoney app is where to begin. Take all your income and put it in the app, select the template suitable for you, and let the app automate all your processes so that you never run out of funds. This way, you will not need loan sharks!

In conclusion, loan sharks are not safe, they are traps, and countries that are faced with their dubious practices take measures to curtail their excesses, and create policies to put them out of business.